|

Current Price:

U308 $81.75/lb*

Effective September 30, 2024

(+$2.25 from survey 1 weeks

prior).

Commentary Update as of

September-2023

Uranium is officially in a

bull market with a 20% rise in price so far in 2023, vastly

outperforming other metals markets.

Uranium scaled $60 per pound on Friday for the first time

since 2011. The breakthrough for the nuclear fuel after a

decade in the doldrums coincided with the last day of the

World Nuclear Symposium in London.

The World Nuclear Association’s (WNA) biennial report

provides long and medium term projections and insights into

the more obscure corners of the global supply chain.

The report has done little to worry uranium bulls, the ranks

of which has grown large in the past couple of years, as the

role nuclear could play in the green energy transition

becomes obvious even to long term critics of the renewable

source.

The nuclear option

The WNA report predicts world reactor requirements for

uranium to surge to almost 130,000 tonnes (~285 million

pounds) in 2040. That’s up from an estimate of 65,650 tonnes

in 2023.

Under the World Nuclear Association upper forecast that

total rise to 184,300 tonnes and even its most pessimistic

forecast – 87,000 tonnes in 2040 – translates to a healthy

rise in demand for the commodity.

From the current 391 gigawatts electricity of operable

nuclear plants, the WNA now projects capacity will reach 686

GW by 2040 under its base case scenario. It’s a hefty

increase of 71 GW from the organization's estimates in its

the 2021 report.

Uranium price makes fresh decade high as forecasts grow

rosier

The bulk of new generating capacity will be located in

China, which is aggressively pursuing nuclear energy to

replace coal, which supplies the bulk of the country’s

energy needs currently. The country has 23 reactors under

construction, 23 planned and a further 168 proposed to add

to its current operating fleet of 53 reactors. Worldwide 436

reactors are currently in operation and another 59 under

construction.

Overall demand projections from the WNA have increased in

the last update, with 4.1% CAGR demand growth expected

through 2040, from 3.1% in its 2021 report.

SMR

The role small modular reactors can play in stoking demand

has kept uranium watchers excited for decades, but now the

promised spike in demand from these technologies are finally

set to have a meaningful impact. Russia is a leader in the

field with two floating SMR reactors entering commercial

operation in 2020 and China is expected to turn the switch

on a land-based reactor in 2025.

A significant portion of the WNA’s upward growth adjustments

can be attributed to the accelerated adoption of SMRs and

the body believes installed capacity will reach 31 GW by

2040.

In a note, BMO Capital Markets says the WNA’s forecasts for

SMRs appear to conservative considering the potential of the

technology’s use in everything from shipping to data centres.

The investment bank’s own forecasts point to 58GW of

installed SMR capacity by the end of the next decade or

around a tenth of nuclear generation capacity which is in

line with the upper band of the WNA’s predictions.

Remote chances

BMO sees SMR boosting mining companies plans around

decarbonisation of operations many of which are located in

remote areas far from power grids. Many mines have replaced

diesel generators with renewable sources like solar power,

but for that you need ample space and the right climate:

“For others, particularly in colder climates such as Canada,

we do see potential for micro-scale nuclear power solutions.

Uranium price makes fresh decade high as forecasts grow

rosier

“Indeed, in much the same way as platinum producers are

championing hydrogen-based trucks by installing them at

their operations, we see an opportunity where uranium miners

could potentially be pioneers in the use of SMRs.”

BMO believes remote mine sites have the best potential for

SMR installations after marine freight and steelmaking.

Security and secondary supply

The report was likely already at the printers when the coup

in Niger grabbed newspaper headlines – but the WNA does

point to “geopolitical instability, notably resulting from

the Russia-Ukraine” resulting in increased interest in

nuclear power for energy security and sovereignty.”

“The same instability has had significant implications for

the globalized market for nuclear fuel cycle services, with

utilities, suppliers and governments in North America and

Europe pursuing opportunities to diversify supplies,” the

WNA says.

WNA believes in the near term, secondary supplies of uranium

will continue to play a role in bridging the gap between

supply and demand as it has for more than three decades. But

there is good news for miners longer term and the WNA

acknowledges in its report the need for new greenfield

uranium projects.

“However, secondary supply is projected to have a gradually

diminishing role in the world market, decreasing from the

current level in supplying 11-14% of reactor uranium

requirements to 4-11% in 2050.“

Secondary supplies include, among others, reprocessed

nuclear fuel, down blending of highly enriched uranium in

nuclear weapons, tailing re-enrichment and stockpiles from

oversupply between 1950–1970, BMO explains. BMO estimates

roughly 3.7 years’ worth of reactor requirements are

currently held as inventory.

------ ------ ------

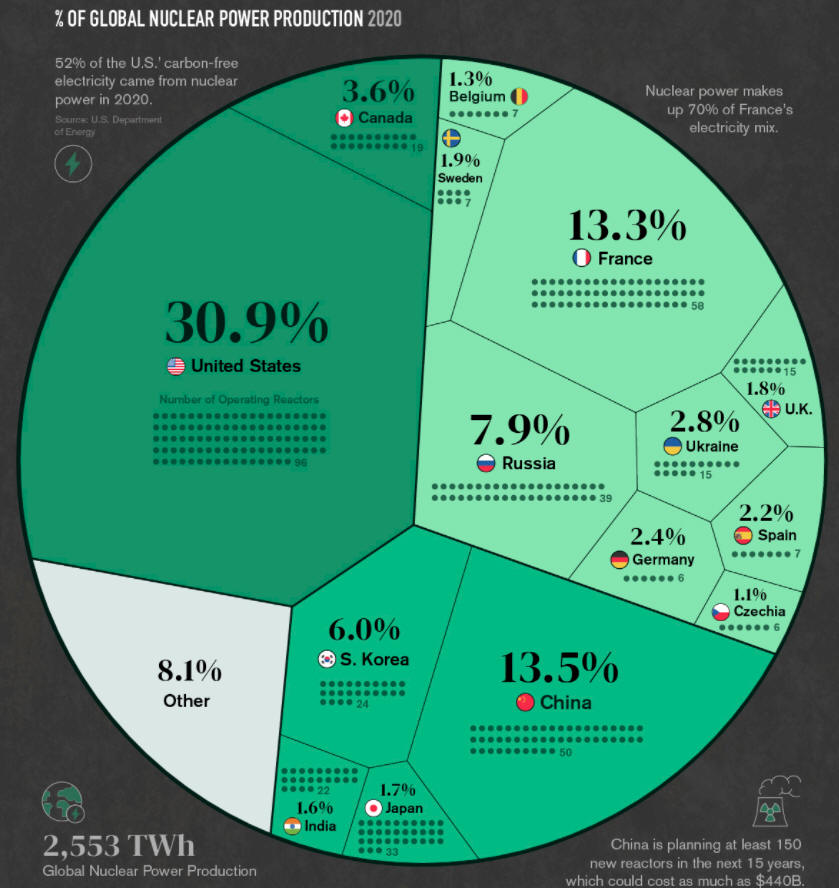

Nuclear power made up 4.3% of

the global energy mix in 2020, supplying many nations with

carbon-free electricity.

Here are the world's nuclear energy powerhouses:

Nuclear Power Production by Country

Nearly 450 reactors around the world supply various

nations with nuclear power, combining for about 10% of the

world’s electricity, or about 4% of the global energy mix.

But while some countries are turning to nuclear as a clean

energy source, nuclear energy generation overall has seen a

slowdown since its peak in the 1990s.

The above image breaks down nuclear electricity generation

by country in 2020 using data from the Power Reactor

Information System (PRIS).

Ranked: The Top 15 Countries for Nuclear Power

Just 15 countries account for more than 91% of global

nuclear power production. Here’s how much energy these

countries produced in 2020:

|

Rank |

Country |

Number of Operating

Reactors |

Nuclear Electricity

Supplied

[GWh] |

% share |

|

#1 |

U.S. |

96 |

789,919 |

30.9% |

|

#2 |

China |

50 |

344,748 |

13.5% |

|

#3 |

France |

58 |

338,671 |

13.3% |

|

#4 |

Russia |

39 |

201,821 |

7.9% |

|

#5 |

South Korea |

24 |

152,583 |

6.0% |

|

#6 |

Canada |

19 |

92,166 |

3.6% |

|

#7 |

Ukraine |

15 |

71,550 |

2.8% |

|

#8 |

Germany |

6 |

60,918 |

2.4% |

|

#9 |

Spain |

7 |

55,825 |

2.2% |

|

#10 |

Sweden |

7 |

47,362 |

1.9% |

|

#11 |

U.K. |

15 |

45,668 |

1.8% |

|

#12 |

Japan |

33 |

43,099 |

1.7% |

|

#13 |

India |

22 |

40,374 |

1.6% |

|

#14 |

Belgium |

7 |

32,793 |

1.3% |

|

#15 |

Czechia |

6 |

28,372 |

1.1% |

| |

Rest of the World

|

44 |

207,340 |

8.1% |

| |

Total |

448 |

2,553,208 |

100.0% |

In the U.S., nuclear power produces

over 50% of the country’s clean electricity. Additionally,

88 of the country’s 96 operating reactors in 2020 received

approvals for a 20-year life extension.

China, the world’s second-largest nuclear power producer, is

investing further in nuclear energy in a bid to achieve its

climate goals. The plan, which includes building 150 new

reactors by 2035, could cost as much as $440 billion.

On the other hand, European opinions on nuclear energy are

mixed. Germany is the eighth-largest on the list but plans

to shutter its last operating reactor in 2022 as part of its

nuclear phase-out. France, meanwhile, plans to expand its

nuclear capacity.

Which Countries Rely Most on Nuclear Energy?

Although total electricity generation is useful for a

high-level global comparison, it’s important to remember

that there are some smaller countries not featured above

where nuclear is still an important part of the electricity

mix.

Here’s a breakdown based on the share of nuclear energy

in a country’s electricity mix:

|

Rank |

Country |

Nuclear Share of

Electricity Mix |

|

#1 |

France |

70.6% |

|

#2 |

Slovakia |

53.1% |

|

#3 |

Ukraine |

51.2% |

|

#4 |

Hungary |

48.0% |

|

#5 |

Bulgaria |

40.8% |

|

#6 |

Belgium |

39.1% |

|

#7 |

Slovenia |

37.8% |

|

#8 |

Czechia |

37.3% |

|

#9 |

Armenia |

34.5% |

|

#10 |

Finland |

33.9% |

|

#11 |

Switzerland |

32.9% |

|

#12 |

Sweden |

29.8% |

|

#13 |

South Korea |

29.6% |

|

#14 |

Spain |

22.2% |

|

#15 |

Russia |

20.6% |

|

#16 |

Romania |

19.9% |

|

#17 |

United States |

19.7% |

|

#18 |

Canada |

14.6% |

|

#19 |

United Kingdom |

14.5% |

|

#20 |

Germany |

11.3% |

European countries dominate the

leaderboard with 14 of the top 15 spots, including France,

where nuclear power is the country’s largest source of

electricity.

It’s interesting to note that only a few of these countries

are top producers of nuclear in absolute terms. For example,

in Slovakia, nuclear makes up 53.6% of the electricity

mix—however, the country’s four reactors make up less than

1% of total global operating capacity.

On the flipside, the U.S. ranks 17th by share of nuclear

power in its mix, despite producing 31% of global nuclear

electricity in 2020. This discrepancy is largely due to size

and population. European countries are much smaller and

produce less electricity overall than larger countries like

the U.S. and China.

The Future of Nuclear Power

The nuclear power landscape is constantly changing.

There were over 50 additional nuclear reactors under

construction in 2020, and hundreds more are planned

primarily in Asia.

As countries turn away from fossil fuels and embrace

carbon-free energy sources, nuclear energy might see a

resurgence in the global energy mix despite the phase-outs

planned in several countries around he globe.

Click to see Uranium Futures =>

Uranium Futures

- CME, or

click here

Uranium/Nuclear focused ETFs:

Click to see

Global X Uranium ETF (URA) =>

Uranium

ETF

Other uranium

related ETF style investment vehicles (focused on nuclear

energy but are not limited to uranium mining and are not direct

competition for URA):

Market Vectors Nuclear Energy (NLR),

and Barclays iShares Global Nuclear Energy (NUCL)

Although we often reference

the spot price of uranium, the long-term price is what

really counts as only a small fraction of the metal is

actually traded on spot prices; over six times more uranium

is traded in long-term market prices than in the spot market

price. The long term market price is consistently and

significantly higher than spot. |

Welcome to Uranium Miner

We track active uranium mining

interests worldwide & provide insight into uranium resource

companies that offer outstanding properties, management and

experience in the mining / exploration industry.

|